- NURS FPX 5010 Assessment 4 Expansion Recommendation.

Expansion Recommendation

ZXY Affiliation is a food association hoping to uphold its responsibilities and open a second creation office. What responsibilities would two new food items seen as staples with steady interest entail? This proposed expansion will require a move up to prepare, requiring a hypothesis of $7,000,000.

The stuff has an evident ten-year lifelength, after which all the stuff and various assets can be sold for a normal $1,000,000. The creation office would be rented, not purchased. ZXY requires a 12 per cent benefit from attempts. It is what’s going on, NOT to propose the expansion. Our decision relied upon the information evaluation recorded under.

Projected Financial Information

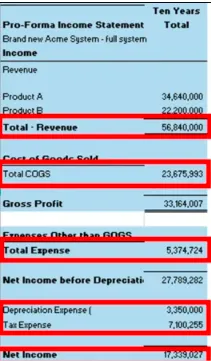

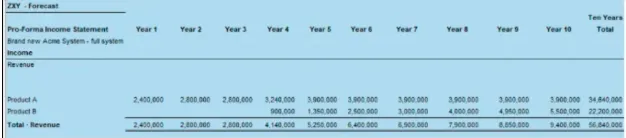

The projected pay for both new things over a decade is $56,840,000. Thing A should contribute $34,640,000 toward the remuneration, while Thing B is examined to make

$22,200,000. You can see these figures in Supplement A. The relentlessly out cost of things sold (Machine gear-pieces) all through an overall timeframe is measured to be $23,675,993; charge costs $7,100,225, sabotaging costs $3,350,001, and other unfaltering expenses are $5,374,724.

Expansion Financial Analysis Overview

To sort out the general expansion, take the consistent expenses from the endless outlay: $56,840,000 – ($23,675,993 + $5,374,724 + $3,350,001 + $7,100,255) = $17,339,027 complete remuneration. You can find these figures in Supplement A. At this point,10 years into the future, the first presented equipment would be sold for around $1M, so we would need to add that figure to the general increment.

Expecting we took that degree of $18,339,027 and deducted the first $7,000,000, we would be left with a net return of $11,339,027. $11,339,027 relegated all through the extent of the ten years is 1.62 or 162%. That 162% distributed years is a norm of 16.2% yearly return constantly for quite a while, satisfying their guideline 12% return for capital-contributed demand, aligning with the financial analysis in NURS FPX 5010 Assessment 4 Expansion Recommendation.

Risk

As we look at risk, we will consider different factors.

• These are new things being done

• It is projected and not guaranteed to Market projections

• Pay rates should not be there for the frontal cortex until year 4

• A speculative $1M plan of the stuff in what’s to come isn’t guaranteed

• Economy (expansion, for example)

• Leasing instead of getting property

Straight Line vs. MACRS

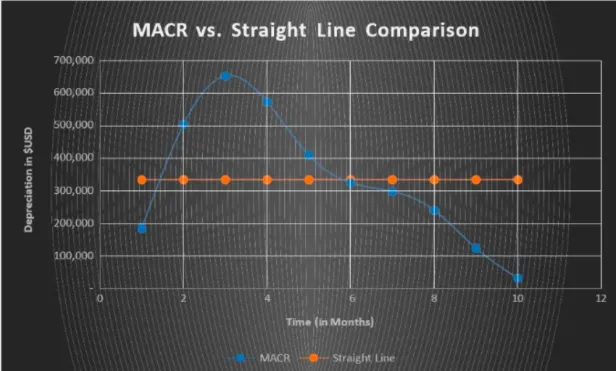

“The MACRS crippling system considers more clear decisions in the early fundamental stretches of an asset’s life and lower prices in later years. According to a general point of view with straight-line debasing, this division ensures a relative cost enrollment dependably until the end of the asset’s usable life (GoCardless, 2020).”

Figure 1.0 – MACRS vs. Straight Line Relationship With these figures

They’ve decided to use a MACRS debasement. In any case, I would have chosen to use a straight line to change the disintegrating more rather than forging ahead through the shot all close to the beginning. This would have an astoundingly major effect on net expansion.

Expansion Recommendation Explanation

The recommendation’s explanation concerns different financial factors in no particular game plan. There is no supporting financial documentation to add credibility to the information and numbers. Dynamic or quantitative parts that we can’t find in the financial verbalizations presented may be issues at large. This is a credit interest for a determined food relationship to open a second creation office.

Financial Challenges and Projections

Yet, the working capital (the contrast between current assets and current liabilities) is clear, which means we don’t have the complete financial achievement picture of the affiliation. Over the long haul, the full-scale pay total happens with effectively hopeless numbers into year 3, working out true to form to hit nearly $1M in the negative before finally posting a positive figure in year 4. We can’t remain mindful of those appraisals at this moment.

Recommendation

Second, the risk is biologically exceptional. Soon after, the recommendation is to DENY the approaches to ensure the expansion. Expecting that the Association would be fiery about orchestrating the terms with a lower return for capital invested, completing one thing with the anticipated workspaces, and trying to lessen a piece of the projected expenses to diminish the risks. Maybe we can reconsider the decision in alignment with NURS FPX 5010 Assessment 4 Expansion Recommendation.

References

Averkamp, H. (n.d.). What is accounts receivable? | AccountingCoach. AccountingCoach.com. Retrieved October 18, 2022, from https://www.accountingcoach.com/blog/what-is-accounts- receivable

Averkamp, H. (n.d.-b). What is the inventory turnover ratio? | AccountingCoach. AccountingCoach.com. Retrieved October 18, 2022, from https://www.accountingcoach.com/blog/inventory-turnover-ratio-2

Esajian, P. (2022, August 3). What Is A Good Debt-to-Equity Ratio? FortuneBuilders. Retrieved October 18, 2022, from https://www.fortunebuilders.com/what-is-a-good-debt-to-equity-ratio/

GoCardless. (2020, October 2). What is MACRS depreciation? Retrieved October 18, 2022, from https://gocardless.com/en-us/guides/posts/what-is-macrs-depreciation/

Inventory Turnover Ratio: What It Is, How It Works, and Formula. (2022, June 28). Investopedia. Retrieved October 18, 2022, from https://www.investopedia.com/terms/i/inventoryturnover.a

Appendix A

Appendix B