- MBA FPX 5010 Assessment 3 Performance Evaluation.

Executive Summary

This summary evaluates the approval or denial of credit requested in the MBA FPX 5010 Assessment 3 Performance Evaluation. Expert Association has applied for credit, and as a credit chief, I am committed to focusing on the financial sufficiency of the relationship to determine whether the credit will be maintained. The application is a 10-year $3 million credit for programming expansion and the acquisition of assembly equipment. This summary includes the reviewed financial records and the recommendation for approval or denial.

The model for 2016 and 2017 records receivable strategies expanded. This gives the nuances that more clients pay utilizing credit. This affects the pay inside the affiliations. This advantage posted in that quarter enlarged the record receivable understanding instead of Cash (Braggs, 2017). This shows the model is not overseeing pondering the development. The records receivable jumping plan from 2016 to 2017 suggests that the money would have been accumulated; rather than focusing on the bookkeeping report, plans would have conveyed an improvement of Cash for the association (Braggs, 2017).

Stock Turnover Rate Analysis

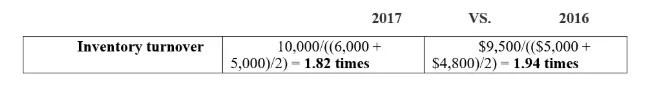

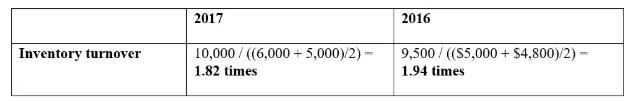

Stock turnover is when a company has sold and re-energized stock through a particular period (O’Connell, 2016). A severe degree shows liberal plans or hurt stock; a low degree shows stock necessities and worth designs (O’Connell, 2016). The stock model overview summarizes the turnover rate improvement from 2016 to 2017. Regardless of how this has evolved, it is still under the business daily.

Pro connection stock turnover displayed for 2016 and 2017:

Dependability is the degree to which a partnership or, at this point, hanging out there is appropriate to get credit (Irby, 2018). The wrapping-up factor relies on the consistency of repaying the money brought in over the time spread to pay on time. Transient money-related support looks at the bet and the security within the credit window (Irby, 2018). After investigating the connection’s financial sufficiency and potential for improvement, the MBA FPX 5010 Assessment 3 Performance Evaluation information shows progress and solid development in some areas in 2016 and 2017. We can assure you of the credit.

References

Braggs, S. Cash due Evaluation. 2017. Recuperated from:

https://www.accountingtools.com/articles/2017/5/15/cash due evaluation

Irby, L. What is Cash-related adequacy? 2018.Retrieved from:

https://www.thebalance.com/what-is-cash related abundancy and-why-is-it-enormous 4159826

Marshall, D., McManus, W., & Viele, D. (2020). Accounting: What the numbers mean (twelfth ed.). New York, NY: McGraw-Hill.

O’Connell, B. Stock Turnover Degree: Definition, Recipe, and How to Use it. 2016. Recuperated from:

https://www.thestreet.com/individual bookkeeping/tutoring/what-is-stock-turnover-degree 14763954

Appendix A.

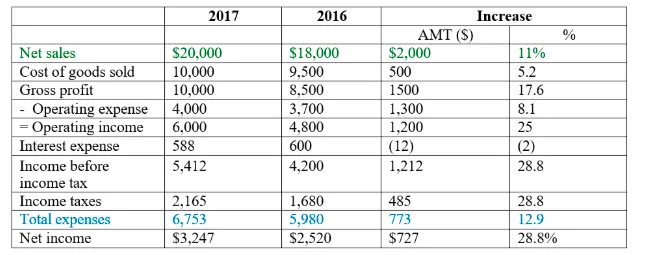

Horizontal analysis of Ace Company (in thousands of dollars)

The analysis demonstrates the dollar variation between 2016 and 2017 divided by the base dollar amount.

Appendix B.

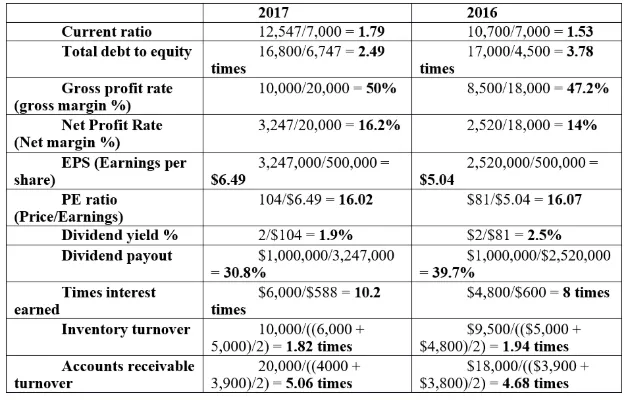

Account Financial ratios.

Appendix C.

Inventory turnover ratios.

Inventory turnover = Cost of goods sold / Average inventories

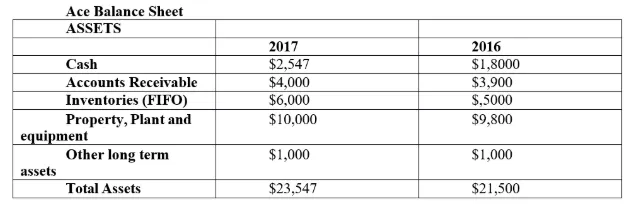

Appendix D.

Ace company Balance sheet

Appendix E.

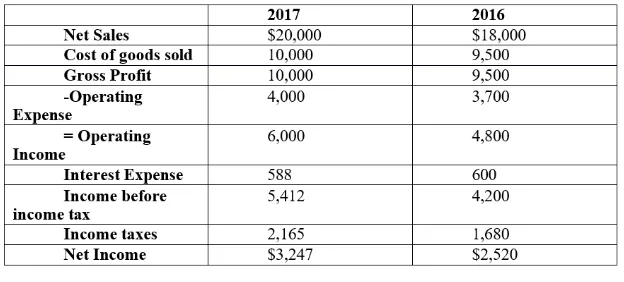

Ace Company Income Statement